Contacts: Melinda Young-Flynn, Washington State Budget and Policy Center; Reiny Cohen, Balance Our Tax Code; Beth Lindsay, Invest in Washington Now

By enacting tax credits for people with low incomes and a tax on the ultra-wealthy, advocates and lawmakers strengthened our tax code

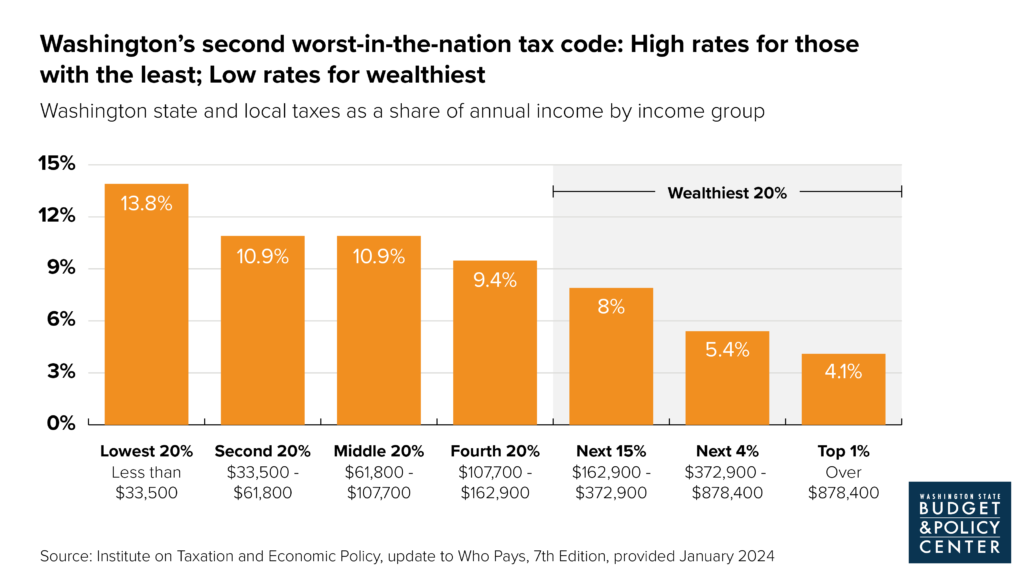

After decades of having a state tax code ranked as the least equitable in the nation, Washington state advocates are celebrating progress toward building a more equitable tax code. Thanks to key policy wins that legislators passed in recent years – namely the capital gains tax and the Working Families Tax Credit – our state tax code moved up one place (with Florida now holding last place), according to new data from the Institute on Taxation and Economic Policy.*

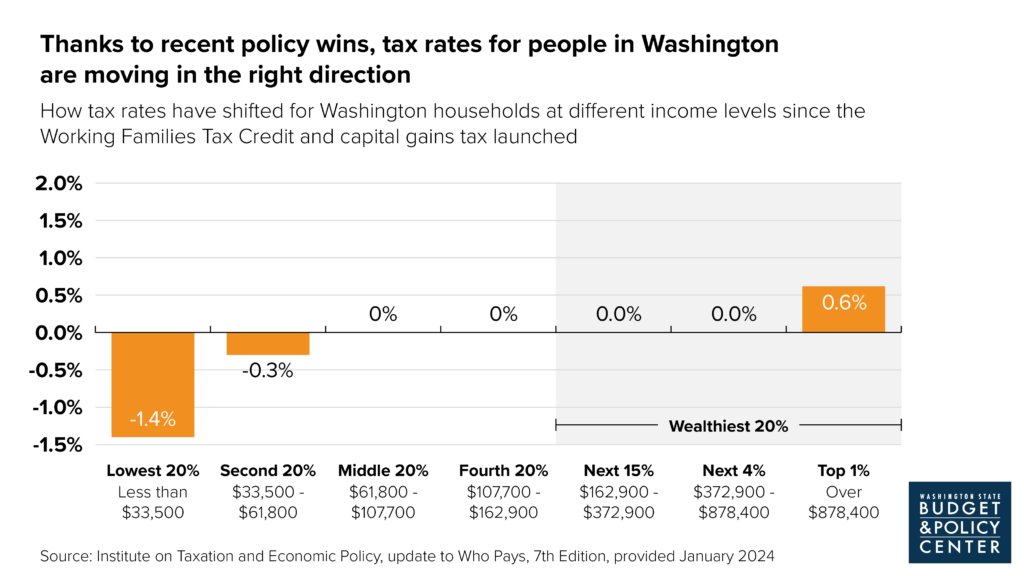

Together, these new policies made our tax code more equitable. Households that earn less than $33,500 annually (the lowest 20% of incomes) saw their state and local taxes drop by 1.4 percentage points as a share of their income, while the wealthiest households (those with incomes over $878,400) saw their state and local taxes increase by 0.6 percentage points. This shifted things in the right direction on an upside-down tax code that has long relied on those with the least to pay the most as a share of income.

Recently enacted policies make a real difference in people’s lives

The capital gains tax and Working Families Tax Credit both launched in 2023, after being signed into law in 2021. The capital gains tax is a modest excise tax paid by the wealthiest 0.2% of Washingtonians, including many billionaires, on capital gains profits above $250,000. The funding from these taxes goes to support child care, early learning, and schools in Washington. The tax has already brought in almost $900 million in revenue in 2023 – far surpassing original estimates – to support kids, families, and child-care workers throughout our state.

The Working Families Tax Credit (WFTC) provides a cash boost of up to $1,200 for households with low incomes in Washington. Unlike the federal Earned Income Tax Credit that our state tax credit is modeled after, our credit importantly includes people who file taxes with an Individual Tax Identification Number. That means undocumented workers and many survivors of domestic violence can qualify for the credit.

Given that Black, Indigenous, and People of Color (BIPOC) are more likely to have low incomes because of inequitable policies that have long excluded them from wealth and opportunity, the WFTC has had an outsized positive impact on these communities. In its first year of implementation, nearly 200,000 households claimed their credit, and more than $114 million in direct cash was paid out. This annual cash boost provides a lifeline to many families and individuals struggling to make ends meet.

“The Working Families Tax Credit and capital gains tax are making our tax code more equitable and helping to level the playing field for kids and families,” said Dr. Stephan Blanford, executive director of Children’s Alliance, a Washington state child advocacy organization. “With the cash boost from the tax credit, so many parents can pay for things that might otherwise be out of reach, like school supplies and bus passes. And the revenue from the capital gains tax will help the families who most need it to afford child care and early learning, while ensuring child-care workers are making living wages.”

Second to last is nothing to brag about

While this higher ranking for our state tax code is definitely good news, being second worst in the nation is still far from where we should be. “In a state known for its innovative spirit and with such massive wealth, we shouldn’t be so far down on this list,” said Treasure Mackley, executive director of Invest in Washington Now. “Our western neighbors Oregon, California, Idaho, and Montana all have tax codes that rank among the top 15 most equitable states.”

The reason Washington is still so low on the list is our state’s reliance on regressive forms of taxes – like sales taxes – that place an oversized share of the responsibility on people with low and middle incomes. And the tax code is still rigged in favor of the ultra-wealthy, with special interests continuing to fight commonsense reform.

As a result, people with low incomes still pay three times higher effective tax rates than the ultra-wealthy.

“It’s unacceptable that even with these recent changes, the lowest-income Washingtonians still pay an effective tax rate that is three times the rate paid by the wealthiest Washingtonians,” said Misha Werschkul, executive director of the Washington State Budget and Policy Center. “I am proud of the progress we have made, and I know advocates won’t give up until Washington leads the nation in how our tax code is structured and how we fund our public services.”

Lawmakers can act this session to keep improving our state ranking

This legislative session, lawmakers must enact more policy solutions to keep moving our state away from its overreliance on regressive taxes.

“Lawmakers have the opportunity to continue to strengthen our tax code this session by expanding the Working Families Tax Credit to remove arbitrary age restrictions, by enacting a wealth tax on billionaires, and by passing a Real Estate Transfer Tax on properties sold for more than $3.025 million,” said Emma Scalzo, coalition director of Balance Our Tax Code “We need our lawmakers to push these bills across the finish line.”

Further, in order to keep our tax code from reverting back into the worst in the nation – and to protect funding that supports the wellbeing of kids and families – lawmakers must stop efforts to overturn the commonsense capital gains tax. The public continues to show strong support for the significant funding this tax is providing to kids and families.

* “Who Pays? A Distributional Analysis of the Tax Systems in All 50 States,” published by ITEP, analyzes tax systems in all 50 states and the District of Columbia. Although ITEP does its best to calculate data that incorporates and reflects the uniqueness of every state’s extremely complex tax code, there are details in the calculations of their data that can’t quite reflect the full structure of Washington state’s tax code. That doesn’t impact the overall rankings.

***

Balance Our Tax Code is a coalition made up of more than 100 labor unions, nonprofits, immigrant rights advocates, human service providers, housing advocates, and activists working to create a tax code that supports a way of life that works for all of us, not just the wealthy few.

Invest In Washington Now is a group of educators, working families, and Washingtonians who advocate for progressive revenue solutions and to ensure the mega-wealthy pay what they owe in taxes.

The Washington State Budget and Policy Center is a nonprofit research and policy organization that works to advance economic justice in Washington state. Using research, analyses, communications, advocacy, and outreach, we seek to create a stronger, more equitable state.