Let’s Rebuild Washington’s Economy To Focus On Financial Wellbeing

For too long, the wealthy few have rigged the rules for their own financial gain. It’s time to pass a wealth tax on billionaires. Our upside-down tax code means that those who make the least pay the most in state and local taxes.

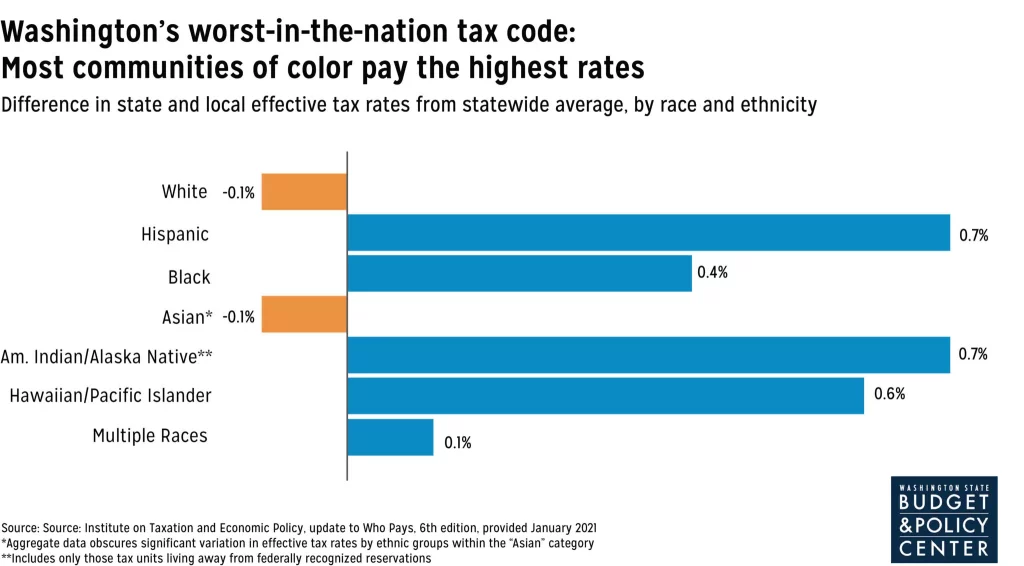

It means that the wealthy few aren’t paying their share. It means that it’s harder for Black and brown communities to build financial wellbeing and pass on wealth.

It doesn’t have to be this way. Working families in Washington deserve to survive and thrive. Take a look at the resources here to learn more about our upside-down tax code, impacts of policy change, and the capital gains tax!

OUR UPSIDE-DOWN TAX CODE

Our upside-down tax code is rigged in favor of the ultra-wealthy. With our broken tax code, Washington’s working families face an uphill battle to financial wellbeing. It’s time for a fair and just tax code in Washington.

Take a look at how our tax code impacts families, communities, and our entire state with these resources.

FIGHTING FOR POLICY CHANGE

When the wealthy pay their share, we can build thriving communities – families with strong financial wellbeing, teachers with fair wages, students with safe places to learn. That’s why we’re fighting for change.

Learn more about how we can all help Washington’s communities, and use these resources to join the fight!

CAPITAL GAINS TAX RESOURCES

In 2021, we came together to pass the capital gains tax. In 2022, we defended it in Washington State’s Supreme Court – and won! This huge step forward helps ensure the wealthy pay what they owe.

Check out the facts, legal resources and media support that helped make the capital gains tax a reality.

OUR UPSIDE-DOWN TAX CODE

Washington has the worst tax code in the nation. We pay our share of taxes, and yet our communities struggle and we don’t have all the resources we need to build good lives for our families.

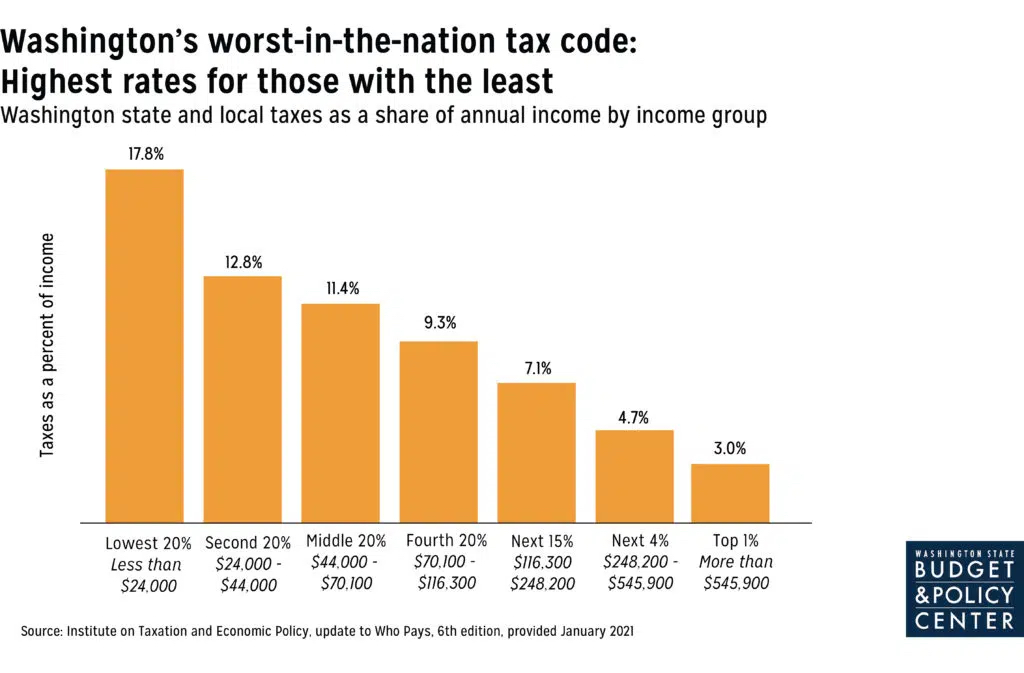

Right now, Washington’s wealthiest residents – mega-millionaires and billionaires – pay less than 3% of their income in state and local taxes. The rest of us pay up to 18%.

Our upside-down tax code deepens the divide between the super-rich and the rest of us. It makes it difficult for families and communities to build and pass on wealth, and disproportionately impacts BIPOC communities.

Fixing our broken tax code is good for Washington – both now and in the future. Access to child care, affordable housing, fully funded schools, economic security, and financial wellbeing improve community outcomes for entire generations.

Washingtonians want a fair tax code. We want communities that have the resources we need to thrive. Take a look at these resources to learn more about the impacts of our upside-down tax code and statewide support for tax justice!

UNDERSTANDING OUR UPSIDE-DOWN TAX CODE

| Report: Budget & Policy Center | Washington state’s upside-down tax code is even more racist than you think |

| Report: Public Integrity | How state taxes make inequality worse |

| Report: Center for American Progress | Disparities in Housing, Health Care, Child Care, and Economic Security Affect Babies for Life |

STATEWIDE POLLING

| Polling: TOPOS Poll | Spur Our Economic Recovery by Asking the Wealthy to Do More |

| Polling: Impact Research Poll | Two-thirds of voters believe raising taxes on the wealthiest and corporations will help the economy |

| Polling: GBAO Poll | Majority Support for Raising Taxes on the Wealthiest Households |

FIGHTING FOR POLICY CHANGE

We’re committed in our fight for a fair and just tax code. Our work has been made possible by thousands of people across the state speaking up for change – from individual advocates to small businesses, organizations, labor unions, and community partners.

We came together to pass the capital gains tax, which has already brought in nearly $900 million for child care and education. We know that when we keep working together to make the wealthy pay what they owe in taxes, our families will have access to affordable housing, working parents will have accessible child care options, and students will have safe places to learn.

Take a look at these resources to learn more about what we’re fighting for, the impact of a fair tax code, and messaging and toolkits for you, your business, your organization, or your community to join the fight!

ADVOCACY IMPACTS

| Petition to State Legislators | Wealth Tax Petition Signed by Thousands of Washingtonians |

| Report: Budget & Policy Center | Washington’s Tax Code is an Untapped Resource to Advance Racial Justice |

| Report: Economic Opportunity Institute | Share the Wealth, Washington! |

| Report: Roosevelt Institute | Bolstering State Economies by Raising Progressive Taxes |

CAPITAL GAINS TAX RESOURCES

In 2021, Washington’s legislature passed the capital gains tax – which has brought in nearly $900 million for child care and education in its first year! The capital gains tax is a huge step forward for Washington. It’s a step toward making sure the super-rich pay what they owe in taxes, so that our families and communities have the resources we need for financial wellbeing.

We’re proud of the capital gains tax, and we’re proud of every Washingtonian across the state who worked hard to make this step toward tax justice a reality. Small businesses, community organizations, unions, and individuals came together – first to advocate for the capital gains tax, and then to defend it in Washington’s courts.

To learn more about the capital gains tax, public support, legal battles, and the State Supreme Court ruling, use the resources below!

THE CAPITAL GAINS TAX: FACTS AND IMPACT

| Budget and Policy Center Fact Sheet | How does the capital gains tax support our communities? |

| Impact by County | The Capital Gains Tax: Statewide Data |

THE CAPITAL GAINS TAX: THE STATE SUPREME COURT

State Supreme Court Legal Resources

| State Reply October 2022 | State’s reply brief |

| Intervenor Reply October 2022 | Intervenor’s reply brief |

| Taxpayer & Working Families Amicus Brief December 2022 | Washingtonians likely to pay the capital gains tax join workers and parents in support of the new law because it will help all Washingtonians |

| Tax & Constitutional Law Professor Amicus Brief December 2022 | Several tax and constitutional law experts explain that the lower court was wrong in calling the capital gains tax a property tax. Based on significant tax law precedent, it is clearly an excise tax |

| Racial Equity Group Amicus Brief December 2022 | Prominent nonprofit and research organizations lay out how the capital gains tax is a critical policy tool to undo some of the racial injustice built into our state tax code |

| Rural Business Owners & Educators Amicus Brief December 2022 | Rural business owners, educators, child advocates, and an economist show how the education and childcare programs funded by the capital gains tax will help Washington’s rural economies and families |

| State Reply January 2023 | State’s answer to Amici |

| Intervenor Reply January 2023 | Intervenor’s answer to Amici |

| State Supreme Court Opinion March 2023 | Washington State Supreme Court Ruling in Favor of the Capital Gains Tax |

State Supreme Court Media Coverage

| Yakima Herald June 2022 | Guest column: Washington state needs a more just tax code |

| Press Release July 2022 | WA Supreme Court Accepts Direct Review of Capital Gains Lawsuit; $500 Million/Year for Students On The Line |

| Press Release October 2022 | WA Supreme Court Hearing Set For Capital Gains Lawsuit |

| Press Release November 2022 | Despite Delay Tactics, Super-Rich Should Be Paying What They Owe in Capital Gains Taxes |

| Seattle’s Child November 2022 | Why Washington needs a capital gains tax |

| Everett Herald November 2022 | Comment: Capital gains tax will give back to kids, families |

| Press Release November 2022 | WA Supreme Court: State Can Start Rulemaking on Capital Gains Tax |

| Press Release December 2022 | WA Capital Gains Tax Is Constitutional, and Needed, say Tax Law Experts, Rural Business Leaders, Racial Justice Advocates, Taxpayers, and Working Families |

| Seattle Times December 2022 | Capital-gains tax: State’s children will benefit |

| Puget Sound Business Journal January 2023 | Katie Baird: Why Washington’s capital gains tax should be upheld |

| Press Background Memo January 2023 | Capital Gains Tax Lawsuit Press Backgrounder Memo – Invest in Washington Now |

| Press Briefing January 2023 | Capital Gains Tax Lawsuit Press Briefing – Invest in Washington Now |

| Press Release January 2023 | Parents, Educators, Supporters “Cautiously Optimistic” After WA Supreme Court Hearing on Education Funding From Capital Gains Tax On Super-Rich |

| Washington Budget and Policy Center January 2023 | It’s time to rule: State Supreme Court should uphold commonsense tax |

| Seattle’s Child January 2023 | A call to Supreme Court to uphold Capital Gains Tax |

| Seattle Times January 2023 | WA Supreme Court can support racial justice with capital gains tax ruling |

| Seattle Times February 2023 | Letter to the Editor: Capital gains tax, ‘A meaningful step toward fairness’ |

| Bellingham Herald & Tacoma News Tribune February 2023 | Capital gains decision should invest $500 million in child care, early learning |

| The Columbian February 2023 | Letter to the Editor: Uphold tax on the wealthy |

| Spokesman Review February 2023 | Denisse Guerrero: Capital gains tax helps right wrongs of state code |

| Seattle Times February 2023 | Debate on capital gains tax confuses the measure’s wisdom with its legality |

| Spokesman Review February 2023 | Sharon H. Chen: Washington’s rich should pay more taxes |

| Everett Herald February 2023 | Comment: State’s capital gains tax can do great deal of good |

| Press Release March 2023 | HUGE Win For Kids, Parents, and Schools WA Supreme Court Validates Education Funding From Capital Gains Tax On Ultra-Millionaires and Billionaires |

THE CAPITAL GAINS TAX: DOUGLAS COUNTY COURT

Douglas County Legal Resources

| Amicus Brief December 2021 | Eastern Washington Leaders Amicus Brief |

| County Court Ruling March 2022 | WA Douglas County Court Ruling for Millionaire Plaintiffs |

Douglas County Media Coverage

| Press Release July 2021 | WA Parents, Teachers, and a School District Asking To Join In Defending Education Funding |

| Seattle’s Child January 2022 | Opinion: Capital gains tax a step toward equity |

| Tri-City Herald February 2022 | These community leaders in Central WA say revenue from capital gains tax is needed |

| Press Release March 2022 | Trial Court Sides With The Super Rich, Ignores Public Support For Funding Childcare, Education By Taxing The Super Rich |