YOUR LATEST TAX JUSTICE NEWS

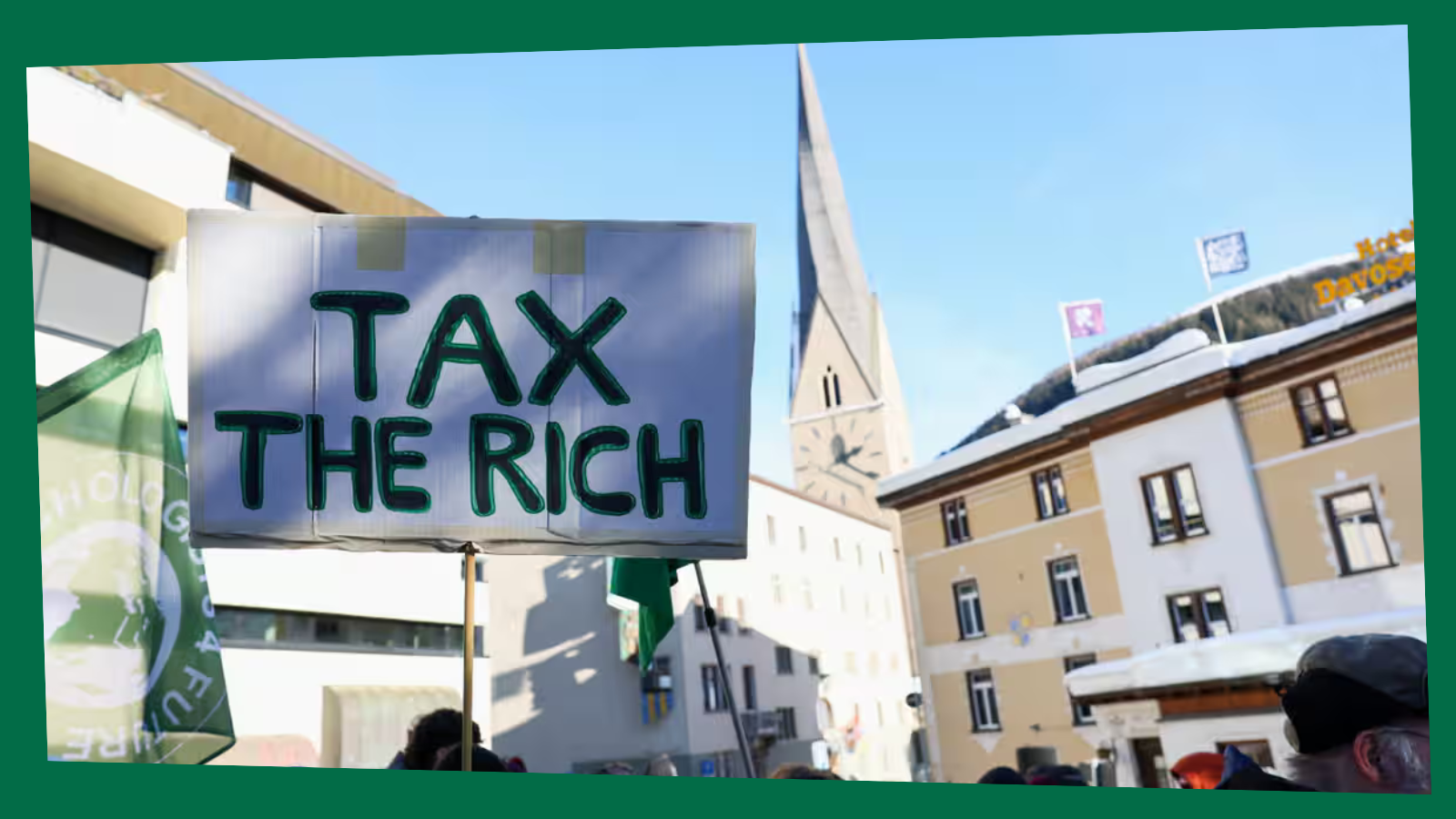

A quick glance at the latest headlines shows mega millionaires and billionaires getting even richer amidst widening economic inequality. The same headlines bring motivation to keep fighting for things like reliable childcare, affordable housing, and the tools we need to thrive.

Sometimes, news celebrates big wins, like the capital gains tax. Other times, we see communities across our state struggling when it doesn’t have to be this way. But with every single tax justice headline, we see just how crucial it is for Washington’s wealthiest to pay what they owe in taxes – just like the rest of us do.

-

Richest Americans Now Pay Less Tax Than Working Class in Historical First

America’s richest are paying less tax than working-class people. In the 1960s, the 400 richest Americans paid more than half of their income in taxes. By 2018, America’s wealthiest individuals paid just 23 percent of their income in taxes. The bottom half of income earners paid 24 percent of their income in taxes.

-

It’s Time to Tax the Billionaires

Why do the world’s most fortunate people pay among the least in taxes, relative to the money they make? The idea that billionaires should pay a minimum amount of income tax is not radical. What is radical is continuing to allow the wealthiest people in the world to pay a smaller percentage in income tax…

-

I’m a child care provider. Washington’s capital gains tax is critical for the families I serve.

Access to child care was critical for working families during the pandemic and still today. High-quality child care is expensive, and the new capital gains tax helps families afford the cost. By taxing the enormous profits the super-rich earn by selling stocks and bonds, our state brought in almost $900 million last year.

-

Lu Hill: We must protect Spokane’s air, water, and natural spaces for ourselves and future generations

Whether we drive a car, take the bus, ride a bike, or walk, we all need roads, sidewalks, & public transportation. And that kind of basic infrastructure takes investment. But a millionaire hedge fund owner and his special-interest friends are trying to roll back laws that help invest in this kind of infrastructure.

-

Meet the Hedgefund Manager Upending WA Politics with 6 Ballot Initiatives

Heywood has almost single-handedly bankrolled 6 initiatives. The unprecedented slate would eliminate the state’s capital gains tax, repeal a landmark climate law, allow people to opt out of a long-term care payroll tax, reverse police-pursuit restrictions, ban income taxes, & guarantee parent access to school medical records.

-

Finally, WA no longer has the nation’s most unfair tax system

Washington is No. 1 for taxing the poor no more. “We are over here celebrating,” said one activist group that has pushed at this boulder since 2006, the Washington State Budget and Policy Center. “Washington no longer has the nation’s worst tax code.”

-

Washington state’s capital gains tax stands as U.S. Supreme Court declines to hear appeal of law

“Polls show Washingtonians strongly support making the wealthiest pay what they truly owe in taxes for services all of us depend on. When the wealthy pay what they owe, just like the rest of us, our communities are stronger,” said Treasure Mackley, executive director of Invest in WA Now, in a statement.

-

World’s five richest men double their money as poorest get poorer

The world’s five richest men have more than doubled their fortunes to $869B since 2020, while the world’s poorest 60% – almost 5 billion people – have lost money. The yawning gap between rich and poor is likely to increase, the report says, and will lead to the world crowning its first trillionaire within a…

-

World’s First Trillionnaire Just 10 Years Away as Richest Men Double Their Wealth

“We’re witnessing the beginnings of a decade of division, with billions of people shouldering the economic shockwaves of pandemic, inflation, and war, while billionaires’ fortunes boom. This inequality is no accident; the billionaire class is ensuring corporations deliver more wealth to them at the expense of everyone else.”