YOUR LATEST TAX JUSTICE NEWS

A quick glance at the latest headlines shows mega millionaires and billionaires getting even richer amidst widening economic inequality. The same headlines bring motivation to keep fighting for things like reliable childcare, affordable housing, and the tools we need to thrive.

Sometimes, news celebrates big wins, like the capital gains tax. Other times, we see communities across our state struggling when it doesn’t have to be this way. But with every single tax justice headline, we see just how crucial it is for Washington’s wealthiest to pay what they owe in taxes – just like the rest of us do.

-

How are billionaire and corporate power intensifying global inequality?

Corporations and billionaires are increasing their wealth at astounding rates while the rest of us are suffering the consequences of their greed. Since 2020, five billion people have become poorer, while the world’s five richest men have more than doubled their fortunes—at a rate of $14 million per hour.

-

The Ultra-Wealthy’s $8.5 Trillion of Untaxed Income

According to an analysis by American for Tax Fairness of new Federal Reserve data, America’s billionaires and centi-millionaires collectively held at least $8.5 trillion of “unrealized capital gains” in 2022. This staggering accumulation of “quiet” income may never be taxed.

-

We can’t keep falling for the myth of ‘billionaire tax flight’

Tax flight is a tired myth, one that anti-tax groups have long used to rig our tax code in favor of the wealthy few. Connecting Bezos’ move to taxes only reinforces conservative fear-mongering against making the wealthy pay what they owe to our communities. There are many more billionaires in Washington who still need to pay what…

-

It now takes at least 6 figures for a family to get by in Seattle

University of Washington researchers recently published that in Seattle it now takes $102,000 to keep a family of four afloat. The people getting squeezed are not “a small nor a marginal group, but rather represent a substantial proportion of households in the state.” It estimates that more than 1 in 4, or about 700,000 households statewide,…

-

Race and Tax Policy in 2023 State Legislative Sessions

“Tax policy is an important tool to mitigate injustices confronting marginalized communities and to advance genuine racial equity. Rather than top-heavy tax cutting that widens the racial wealth gap, states should consider strengthening refundable tax credits and boosting revenue through progressive tax increases on high-earners and corporations.”

-

Billionaires are out of touch and much too powerful

Disproportionately older, white and male, billionaires function as unelected powers. They use their power in arbitrary, reckless and often environmentally destructive ways. The US has a quarter of the world’s 2,700 or so dollar billionaires. But extreme wealth is itself bad for democracy.

-

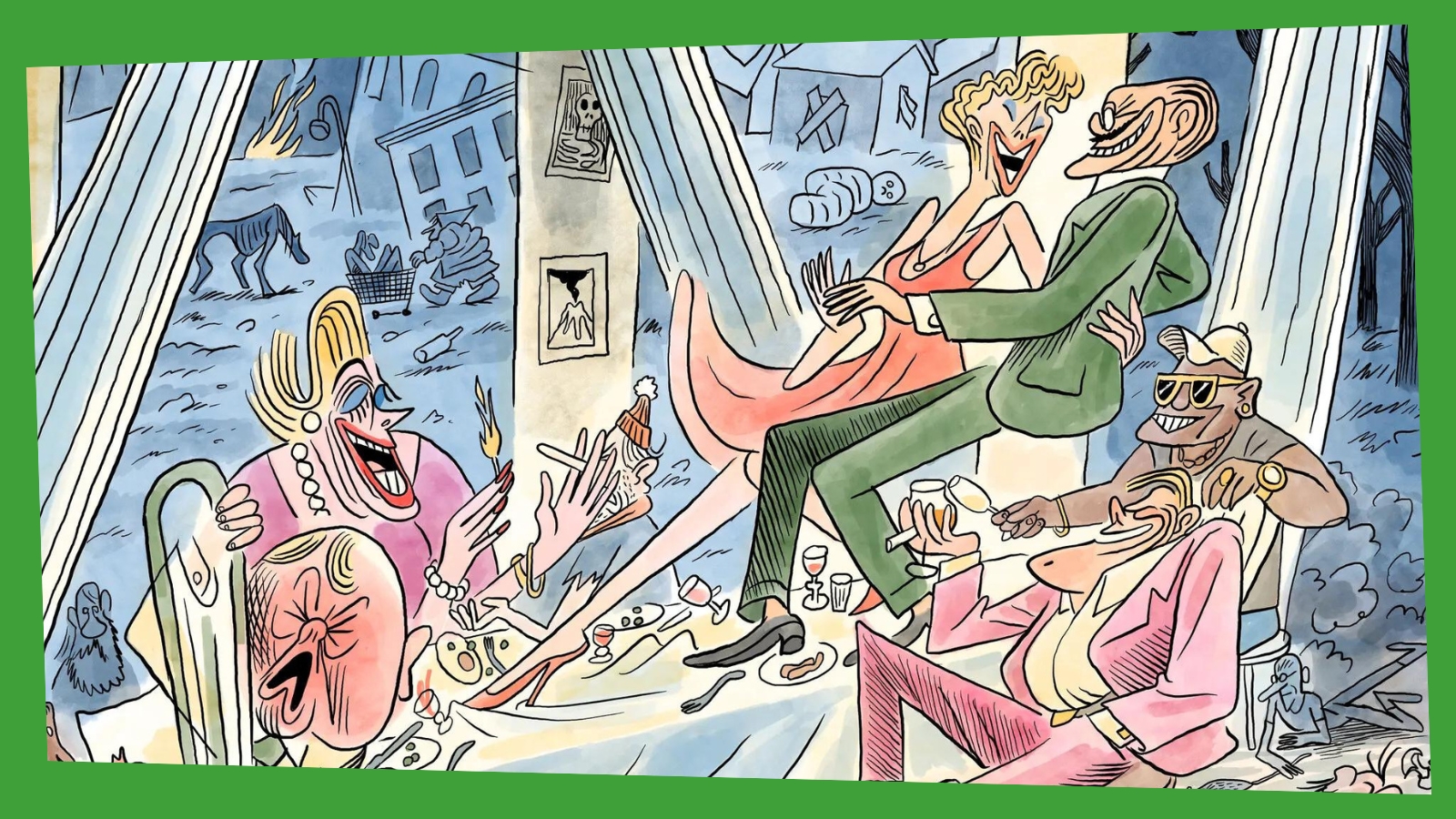

What Happens When the Superrich Are This Selfish? (It Isn’t Pretty.)

Today’s rich, their wealth largely preserved through the Great Recession and the Covid-19 pandemic, have opposed reforms aimed at tapping their resources to fund mitigation policies of all kinds. For the rich, protecting their fortunes from crises also involves protecting them from extra taxation, thus stripping public institutions of resources.

-

State hauls in nearly $900M from first year of capital gains tax

“The new funds could not come at a more needed time given the budget shortfalls that school districts across the state are seeing,” said Treasure Mackley, executive director of Invest in WA Now, which pushed for the tax. “These projections show that we have the ability to invest in our kids’ futures – when the…

-

WA has the wealth, but not the will, to fund schools equitably

Six years after the Legislature’s McCleary fix to right-size education funding, many Washington students continue to languish academically. And high poverty districts receive about $880 less per pupil than more affluent areas. That is far from the spirit of the McCleary lawsuit settlement.